Questions left unanswered?We’re here to help. Jump into Discord and we’ll get you sorted.

Samsara

Is Samsara a permissionless launchpad?

Is Samsara a permissionless launchpad?

No, all Samsara listing are decided by the team. If you would like to sugeest a token listing, please contact the team through official channels. However, multiple permissionless AVM launchpads are currently in development by other teams, which will drive value back to ANA through integration fees.

How do the navToken launches work?

How do the navToken launches work?

Where do I apply for listing a token?

Where do I apply for listing a token?

Head over to our Build page.

How does Samsara compare to Nirvana?

How does Samsara compare to Nirvana?

Nirvana is built around ANA, minted with USDC. The protocol accumulates USDC reserves, which back ANA’s perpetually rising floor and unlock interest-free, liquidation-free credit against those reserves.Samsara extends this model through navTokens. Instead of USDC as the reserve asset, each navToken market holds its own base asset as reserves. navSOL is minted with SOL, backed by SOL, and has a floor denominated in SOL. Same AVM mechanics, but native to the underlying asset rather than a stablecoin.The key difference: Nirvana gives you a dollar-backed floor with credit utilities. Samsara gives you asset-native floors, meaning your downside is protected in terms of the asset itself, not in dollar terms.Same philosophical foundation, different reserve architecture.

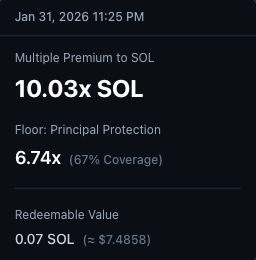

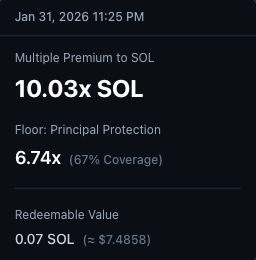

What is the multiplier?

What is the multiplier?

The multiplier shows how many times the current navToken price has grown relative to its launch price, in terms of the underlying asset.For example: A multiplier of 10x means navSOL is currently trading at 10 times its starting price in SOL. This is driven by the bonding curve: for every 15,000 navSOL minted, the price rises by one starting price increment. The higher the multiplier, the more net inflows the protocol has absorbed.

Tokenomics & Allocation

Is there a team or insider token allocation?

Is there a team or insider token allocation?

No. Nirvana has no team or insider allocations. Every navToken in existence (including ANA) was minted through the protocol in a fair exchange. Any pre-mint or insider distribution would compromise solvency, so it’s disallowed by design. Likewise, there is no insider NIRV or prANA allocations. The team is funded by a portion of fees.

How are tokens on Samsara minted?

How are tokens on Samsara minted?

In the same way as ANA, preminting would compromise solvency. That means every navToken is minted with its base asset; no other tokens exist. In other words, every navToken was bought fairly and is backed by a portion of its base asset.

The Floor Mechanism

How are navToken floor prices impenetrable?

How are navToken floor prices impenetrable?

Does the floor ever go down?

Does the floor ever go down?

No. Once the floor ratchets up, it never lowers. It either stays level or rises, permanently locking in gains for the navToken.

What happens if the price trades back to the floor?

What happens if the price trades back to the floor?

The AVM will continue buying the navToken at the floor price— its bid is large enough to fulfill the sale of every token in supply. The very next buy after reaching the floor has a positive price impact, so downside is capped while upside resumes immediately with demand— an asymmetric setup that discourages panic selling. Also, selling into the floor is actually healthy for the protocol. As the sold navTokens are burned, less capital is required to raise the floor, so the trigger price decreases while the floor price remains impenetrable.

Why is there a cooldown on floor raises?

Why is there a cooldown on floor raises?

The floor can rise at most once every 5 minutes. This throttle prevents sudden, cascading ratchets, giving the market time to react to each step up.

Liquidity & Solvency

Can the protocol run out of exit liquidity?

Can the protocol run out of exit liquidity?

By design, no. The AVM’s pricing function is entangled with the solvency invariant. The area under the price curve always equals the total reserves, ensuring it can buy back 100% of the navToken supply for at least at the floor. When a navToken is sold, it’s burned, which reduces future obligations one-for-one.

How can I verify ANA's solvency/liquidity?

How can I verify ANA's solvency/liquidity?

ANA’s reserves are held in a transparent on-chain reserve which can be inspected here: https://explorer.solana.com/address/BcAoCEdkzV2J21gAjCCEokBw5iMnAe96SbYo9F6QmKWV/tokensTo easily verify the solvency of ANA’s floor price, you can check the reserve’s balance of USDC and NIRV (above), and compare that to the ANA’s floor price and circualting supply. Stablecoin reserves (USDC + NIRV) will always be greater than or equal to required floor reserve (ANA supply x ANA floor price.)

Governance & Control

Who controls fees and parameters?

Who controls fees and parameters?

prANA holders. Governance runs on an incremental cadence, adjusting parameters (fees, emissions, etc.) via on-chain votes so markets stay resilient over time.

How can I join governance?

How can I join governance?

We have outlined the process of governance step by step here.

Leverage & Borrowing

How does looping (leverage) work?

How does looping (leverage) work?

Looping is a strategy where you stake a navToken, borrow the reserve asset against its floor value, and use those funds to mint more of the navToken. This increases your exposure to the navToken, magnifying both potential gains and losses.Unlike traditional leverage, looping an navToken is free from liquidation risk and interest. Because the protocol only permits you to borrow up to the asset’s floor price, which is mathematically enforced and can never fall, your debt can never exceed the redeemable value of your collateral. Even if the market price drops all the way to the floor, your position remains fully solvent, eliminating the risk of a forced liquidation. Do note, however, that “max looping” your position means that if the market price drops to the floor price, your collateral value would be practially equal to your debt, so the position would have no liquid value. But, becasue you maintain your collateral, the value of your position will still rise with price.

Does my staked ANA still earn prANA when I borrow against it?

Does my staked ANA still earn prANA when I borrow against it?

Yes. All staked ANA earn prANA at an equal rate, regardless of your debt position. This means that looping your ANA position increases your prANA yield.

Couldn't someone get infinite leverage at the floor price?

Couldn't someone get infinite leverage at the floor price?

Not exactly. The protocol has no limits to how many times you can loop your position. But, in practice, two economic factors limit the amount of leverage you can achieve: price impact, and protocol fees. Buying a navToken always create positive price impact, even if the market price is at the floor. Therefore, all buy prices are technically above the floor, so that spread beween floor price and buy price limits leverage. Similarly, buy fees and borrow fees (both governable) limit realized leverage.Example: Market price and floor price are both $1, and your average buy price is 1.005 after price impact. So 1% (borrow fee) + 0.5% (buy fee) + 0.5% (price impact) = 2% average loss in LTV per loop, or a true LTV of 98%, which equates to 50x leverage.

How does NIRV stay pegged to USDC?

How does NIRV stay pegged to USDC?

NIRV is a USD stablecoin backed by verifiable, protocol-owned liquidity. Its peg is secured by the fact that the underlying collateral (ANA’s floor) is backed by USDC reserves.When users borrow NIRV, their ANA collateral is locked. That locked ANA cannot be sold until the NIRV loan is repaid, creating a closed loop that ensures NIRV is backed by USDC 1-to-1. In other words, NIRV is effectively wrapped USDC. USDC fully backs the ANA floor, and the ANA floor fully backs NIRV.In essence, NIRV represents tokenized USDC leverage, and becasue this leverage is fully collateralized (and has no oracle risk), it can be fully unwound, or deleveraged, while maintianing constant 1-to-1 backing and solvency.The AVM accepts NIRV as equivalent to USDC when purchasing ANA, so any deviation from the peg on secondary markets creates a risk-free arbitrage loop (Buy discounted NIRV → Mint ANA → Sell ANA for USDC). This loop is always liquid and solvent, which forces the NIRV price back to 1 USDC.